No renovation work for years to come, solid guarantees from the developer, and all the comfort of a brand-new home — buying off-plan, also known as VEFA (Vente en l’État Futur d’Achèvement), appeals to many buyers each year. Still hesitant because you’re unsure of the ins and outs of this type of purchase? This article breaks down how it works, the advantages, and the key things to watch out for when buying off-plan.

What is VEFA or off-plan buying?

VEFA (Vente en l’État Futur d’Achèvement), commonly referred to as “off-plan purchase,” is a specific form of property acquisition. In this case, the buyer deals directly with a property developer or, in some cases, one of their collaborators or partners.

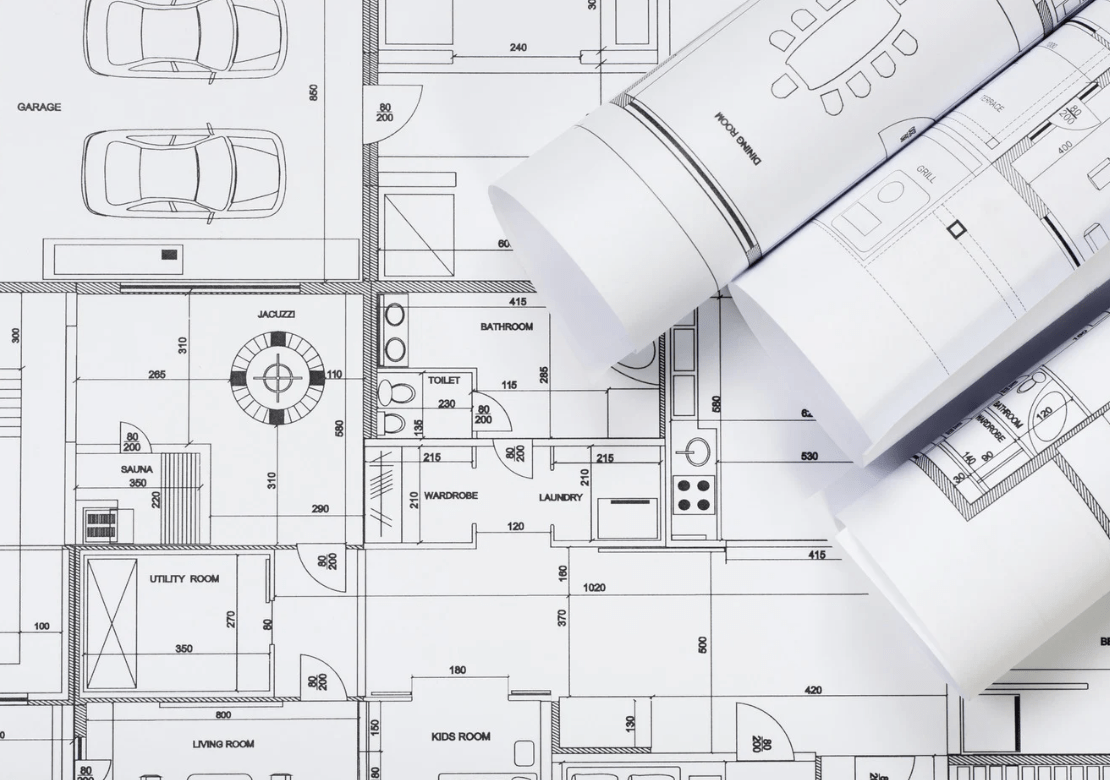

By purchasing off-plan, you’re reserving a property that hasn’t been built yet. Your project is based on plans and contracts provided by the developer. Depending on the stage of construction and the context of the sale, you may have more or less flexibility in customizing the layout and finishes.

What are the benefits of buying off-plan?

A fiscally attractive investment

With a VEFA purchase, part of your investment is subject to a reduced VAT rate of just 3%. In addition to this appealing advantage, you may also benefit from other incentives such as mortgage interest deductions. Make sure to seek guidance from professionals — they’ll help you structure your investment optimally.

A favorable market context

In today’s market climate, buying off-plan is more appealing than ever. With conditions softening, many developers are more open to negotiation and offer attractive purchase conditions.

In a strong position, you’ll be able to negotiate several aspects in your favor — such as having a fully equipped kitchen included or obtaining premium finishes at no additional cost.

Excellent energy performance

Off-plan homes typically offer top-tier thermal and acoustic performance. They’re built using high-quality materials and the latest innovations for optimal insulation.

You’ll also benefit from efficient heating systems, double-flow ventilation systems for superior indoor air quality, and smart home features that enhance comfort and convenience.

Some off-plan homes even include advanced sustainable features, such as photovoltaic panels or rainwater harvesting systems. In short, VEFA is an excellent way to reduce your energy consumption and carbon footprint.

No renovation work for years

Buying a new flat or house off-plan means peace of mind for years to come. Everything is brand new, so you won’t need to budget for expensive renovation work — a reassuring prospect.

Safety, Insurance, and Quality Commitments

Developer commitment to quality

Many developers who are members of the Developers’ Section of the Chambre Immobilière have signed the Charte de Qualité Logement (charte.lu), a sector-led initiative that goes beyond legal requirements.

By signing, they commit to principles of transparency, quality, responsibility, and ethics throughout the entire development process.

For the buyer, it is an additional guarantee of professionalism and trustworthiness.

Mandatory ten-year liability insurance

Developers are also legally required to carry ten-year liability insurance, which protects buyers from major construction defects should the developer or builder default.

They work only with certified architects, approved contractors, and specialized insurers — a level of coordination essential to ensuring the structural reliability of the building and fulfillment of commitments.

What are the risks of buying off-plan?

As with any property project, buying a home off-plan should be properly supervised. Ideally, work with professionals who can guide you toward making informed decisions.

Several points require special attention in a VEFA transaction:

- Expect potential delays due to weather conditions, technical issues, or supply chain problems. Read the contract carefully — it should detail these possible delays and include any applicable penalties or compensation.

- Check for discrepancies between the reservation contract and the final sales contract. Since they are signed at different stages, some variations in price or specifications can occur.

- Plan the staged release of funds with your bank in advance to avoid cash flow issues during construction.