In the vast majority of cases, the purchase of a property is based on a mortgage loan, which families generally repay over a few decades, 30 years at the most. This depends heavily on the nature of the property and the needs of the client. Once you have decided on a property, you must have a financing plan in mind: the total expenses, the resources available and a concrete idea of the amount to be borrowed.

Expenses: Don’t Forget Any Details!

Keep in mind that, when investing in real estate, the cost price of the property itself is not the only thing that new owners must finance. Although this is the main item of expenditure, you should not overlook the ancillary costs that will need to be paid to complete your project. For example, you will have to support notarial costs that remunerate the notary handling the transaction: he will recover the taxes to be paid to the tax authorities, claim reimbursement for some expenses (costs relating to the request of some administrative documents) and will also bill you for his fees. In addition to this, there may be insurance costs, a commission linked to your file and other administrative costs.

“Do not overlook the ancillary costs that will need to be paid to complete your project.”

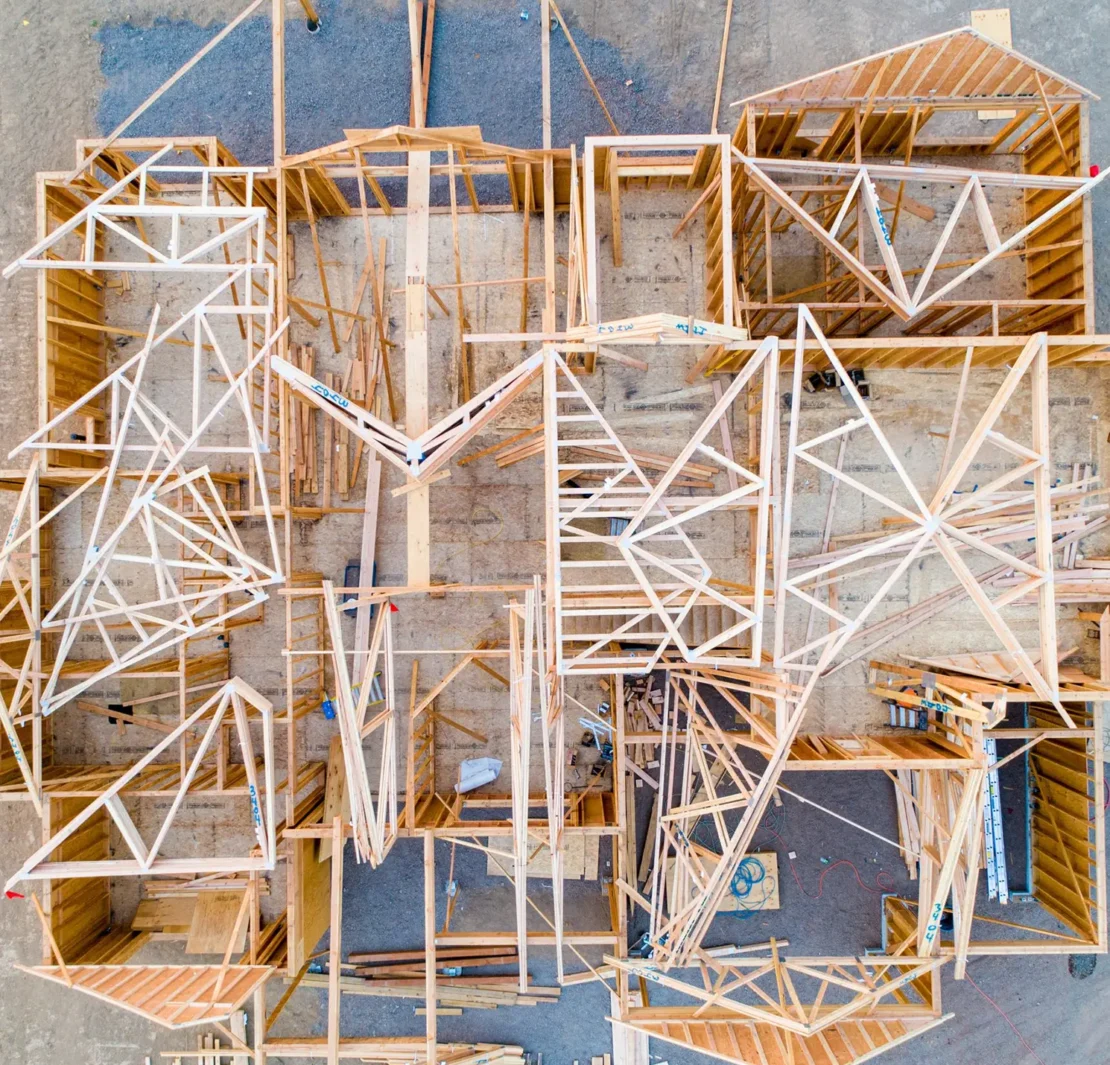

La construction, l’achat, la rénovation voire la transformation d’un logement est un projet important. Une telle aventure, impliquant un investissement financier et personnel conséquent, mérite une préparation minutieuse et un partenaire financier de confiance. Les Conseillers Logement de Spuerkeess, Banque N°1 des prêts immobiliers, se tiennent à votre disposition pour déterminer, ensemble avec vous, un plan de financement sur mesure, parfaitement adapté à vos besoins.

Resources: What Is the Amount of Down Payment You Can Afford?

Of course, to face all these costs, you can take into account all your resources: savings, inheritance, or the amount from the sale of your previous property (if you are not a first-time buyer). In the latter case, you could apply for intermediate financing in the form of a bridge loan while waiting for the sale of your first property. This analysis of the capital immediately available for purchase will allow you to estimate the amount of down payment you can afford.

Depending on the credit institution you chose, a down payment around 20 to 30% of the total price is recommended. If all your available resources are not enough to gather the required amount, consider a mortgage on another property or land, or ask someone close to you to act as guarantor. You can also try to negotiate a lower down payment with the bank. The State Guarantee can as well help you to become a homeowner.

Borrowing: Calculate Your Repayment Capacity Precisely

After analyzing your capital resources, you will need to estimate your monthly income and expenses in order to know precisely your debt capacity. In concrete terms, this is the amount you can spend each month on credit without getting into trouble. Most often, banks consider that this “capacity” should not exceed one third of your total income.

Naturally, to make maximum savings on interests and loan insurance, you should shorten the term of the mortgage as much as possible. Because the faster you pay back the loan, the cheaper the loan! Even so, this choice means that monthly payments increase: make sure you keep enough money to provide for the whole family, even in case of unforeseen events. An Outstanding balance insurance (OBI) can provide additional security in case of death of the insured party; it covers the outstanding capital balance that will be paid out to the beneficiary of the insurance.

“The faster you pay back the loan, the cheaper the loan.”

Financing plan: Don’t Set It up Alone!

The more precise and solid your financing plan is, the more likely it is to succeed. Do not hesitate to ask professionals for advice in setting it up, in order to anticipate all expenses and to respect the maximum debt rate tolerated by the banks.

If you want to get a first glimpse of what awaits you, set up your own financing plan free of charge at https://www.bcee.lu/en/housing/planning/.

Naturally, structures that grant credits require many guarantees and a certain professional stability. Prepare now your latest pay slips, ask for a salary certificate and collect all the quotations needed if you plan to make works in the future property. Thus, you will have a proper file ready and complete to submit to the banker…